Understanding Presentation and Disclosure in Financial Statements

Author: DM Technical Team : January 2026

IFRS 18 – Understanding Presentation and Disclosure in Financial Statements

On 9 April 2024, the IASB issued International Financial Reporting Standard 18 (IFRS 18) “Presentation and Disclosure in Financial Statements”. IFRS 18 is a key standard, having the objective to set out the overall requirements for the presentation and disclosure of financial statements, ensuring they are relevant, comparable, and faithful. The new standard replaces IAS 1 “Presentation of Financial Statements” and aims to refine and enhance presentation and disclosure requirements. IFRS 18 applies to all financial statements prepared and presented in accordance with IFRSs.

IFRS 18 is to be applied retrospectively for annual reporting periods starting from 1 January 2027, where early application is permitted. The standard has yet to be endorsed by the EU. This endorsement is expected before the effective date.

Complete set of financial statements under IFRS 18

IFRS 18 identifies a complete set of financial statements as follows:

-

- a statement (or statements) of financial performance for the reporting period: either a single statement or a statement of profit or loss immediately followed by a separate statement presenting comprehensive income beginning with profit and loss

- a statement of financial position as per the end of the reporting period

- a statement of changes in equity for the reporting period

- a statement of cash flows for the reporting period

- comparative information

- a statement of financial position as at the beginning of the preceding period if the entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements or reclassifies items in its financial statements

- notes for the reporting period

Transitional impact

The new standard will be effective for annual reporting periods beginning on or after 1 January 2027. Retrospective application is required, therefore comparative information needs to be prepared under IFRS 18.

In the year of adopting IFRS 18, the standard requires a reconciliation for each line item in the statement of profit or loss regarding the comparative period immediately preceding the year of initial application. A disclosure is required, showing how its restated amount (prepared under IFRS 18) reconciles to the amount disclosed in the previous financial statements in accordance with IAS 1.

A further transitional provision relates to the measurement of investments in associates or joint ventures held by an entity that is a venture capital organisation or certain other entities. Such an entity can change to measuring its investment at fair value through profit or loss when applying IFRS 18 for the first time if the equity method was previously used to measure the shares.

Changes introduced by IFRS 18

IFRS 18 introduces new requirements for information presented in the primary financial statements and information as disclosed in the notes. Compared to IAS 1, the main changes in IFRS 18 are:

-

- Presentation of newly defined subtotals in the statement of profit or loss, and consistent classification of income and expenses into five categories.

- Disclosure of information on management-defined performance measures (MPMs).

- Requirements for grouping of information (aggregation and disaggregation).

- Improvements to the statement of cash flows (effect of IFRS 18 on IAS 7).

Presentation of newly defined subtotals in the statement of profit or loss

IFRS 18 introduces two new subtotals in the statement of profit or loss: ‘Operating profit’ and ‘Profit before financing and income tax’. In addition to the required subtotals, an entity must present additional subtotals in the statement of profit or loss when such presentations provide a useful structured summary of the entity’s income and expenses.

The profit or loss statement is to be divided into five categories, thereby providing more structure and comparability.

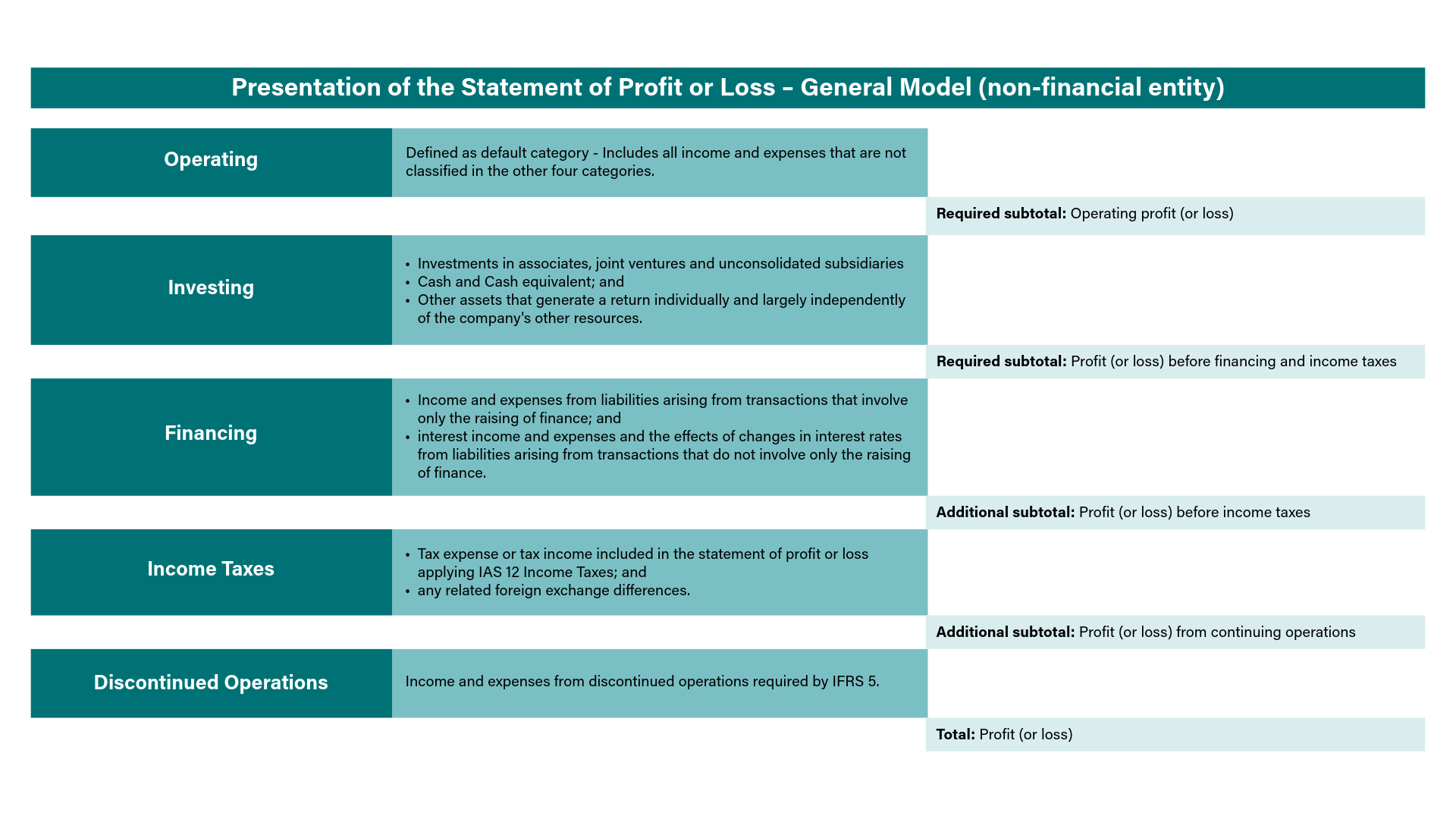

The schedule below illustrates the General Model (non-financial entity) for the presentation of the statement of profit or loss. In the next section, we explain how this presentation can be adopted for financial entities such as investment funds and banks.

Figure 1: Presentation of the statement of profit or loss – General Model

Application of the General Model to financial entities

The General Model is not suitable for financial entities where investing and financing are part of the main business activities of the entity. The following text explains how the statement of profit or loss is structured from the perspective of an entity’s main business activities, emphasizing the specific requirements of IFRS 18 for financial entities.

Operating profit is designed to include income and expenses from the entity’s main business activities. The General Model would therefore not be suitable for financial entities such as investment funds and banks where the main activity of business consists of investing or financing activities. IFRS 18 requires entities with specified main business activities to move income and expenses from the investing and/or financing categories to the operating category when these represent the main activities of an entity.

An entity is required to assess whether it:

invests in assets as a main business activity; or

The last two categories, tax income and discontinued operations, are the same for all entities regardless of the main business activity.

Disclosure of information on management-defined performance measures

Management-defined performance measures (MPMs) are a subtotal of income and expenses that:

are used in public communications outside financial statements;

Many entities provide MPMs in their communication with investors. The MPMs sometimes differ from one period to another or are communicated through various channels and publications and therefore, are hard to find.

IFRS 18 requires an entity to disclose information about any MPM in a single note to the financial statements. This note will have to include:

With the requirements on MPMs, the IASB aims to address items raised by responders during the consultation phase. The IASB considers it an improvement to have the MPMs in a single location, that being the disclosure notes to the financial statement (instead of across multiple communications) and therefore expects the MPMs to be in scope of the financial audit.

Requirements for grouping of information

IFRS 18 provides guidance on the objectives of the financial statements and the disclosure notes. These objectives should help entities decide which information to include in the primary financial statements and the notes.

The objective of the primary statements is to provide a structured and comparable summary of an entity’s assets, liabilities, income, expenses and cash flows. The objective of the notes is to provide material information necessary to understand the items included in the primary financial statements and supplementary information that is necessary to meet the objectives of the financial statements.

Entities will need to classify items into groups based on shared characteristics (at least one characteristic, for example based on measurement method or exposure of risk) and separate those line items in the notes based on further characteristics (material items). Entities will classify some operating expenses by function and others by nature if doing so would provide the most useful structured summary of its expenses.

An entity that presents one or more line items for operating expenses classified by function is required to disclose the amounts for five specified expenses by nature related to each line item in the operating category of the statement of profit or loss. The expenses required to be disclosed are:

-

- depreciation;

- amortisation;

- employee benefits;

- impairment losses and reversals of impairment losses; and

- write-downs and reversals of write-downs of inventories.

Entities should use meaningful labels for groups of immaterial items, avoiding line items such as ‘Other expenses’. Entities would be required to provide information in the notes about the content of such groups if it is not possible to avoid in the primary financial statements. A disclosure indicating that an aggregated item consists of several unrelated immaterial amounts and indicating the nature and amount of the largest item are sufficient.

Improvements to the statement of cash flows

IFRS 18 has resulted in consequential amendments to IAS 7 Statement of Cash Flows. The IASB require an entity to use the operating profit or loss subtotal as the starting point when using the indirect method to present the statement of cash flows. The IASB also reduced the presentation alternatives currently permitted by IAS 7 and requires entities to present interest and dividend cash flows.

Entities that provide financing or investment activities as their main business activity can classify the corresponding cash flows into the same category, for example operating in the statement of profit or loss and operating in the statement of cash flows, as classified in the statement of profit or loss.

Conclusion

The new standard is effective for annual periods on or after 1 January 2027 but companies will need time to interpret and implement the new requirements based on their specific circumstances. This will require management to exercise judgement when deciding how to communicate the new information clearly and concisely and to ensure that they focus on entity specific information in order to avoid standardised boilerplate accounting disclosures.

Meet the Authors

Senior Manager, Financial Reporting

Waldemar Drejer

Senior Manager, Financial Reporting

Location

Ireland

Service line

Financial Reporting, Technical Team

Senior Manager, Financial Reporting

Emma Cosgrove

Senior Manager, Financial Reporting

Location

Ireland

Service line

Financial Reporting, Technical Team

Managing Director, Financial Reporting

Mohamed el Annouri

Managing Director, Financial Reporting

Location

The Netherlands

Service line

Financial Reporting, Technical Team

Waldemar Drejer

Emma Cosgrove